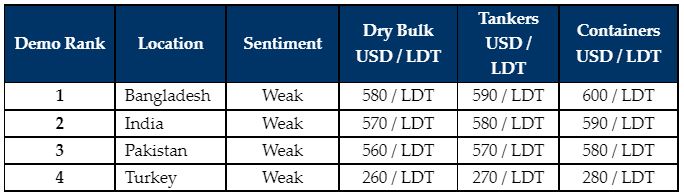

Low recycling prices for vintage tonnage are expected to hinder any increase in the number of units sold over the next few weeks. In its latest weekly report, shipbroker Clarkson Platou Hellas said that “we are trying to establish from where a concession will appear, the Sellers or the Buyers! On the outside we do not envisage many units to come for recycling for the next month at least and therefore it would need the actual recyclers to increase their rates to tempt any Owner contemplating a recycling sale. However, financial restraints and weakening currencies against the U.S. Dollar continue to put cause for concern amongst the Indian sub-continent recycling community and ensures no over-inflated levels at this current time. There are rumours abound of Letters of Credit unable to be opened for larger LDT tonnage, particularly from Bangladesh, which further creates difficulties when and if a vessel of this ilk comes for sale. We are now witnessing actual sales of tonnage for recycling fall to their lowest levels in a decade and certainly we cannot predict a massive change any time soon during the summer months and heading into the final quarter of 2022”, the shipbroker said.

In a separate note this week, Allied Shipbroking added that “the ship recycling market appears in a rather “weird” state as of late. Activity has slowed down significantly, that is partly though explained from seasonality factors, but scrap price levels continue experiencing considerable pressure as well, for a period now.

In the separate demo destinations and more specifically that of Bangladesh, things are losing momentum, given the currency depreciation and the recent shortage of US Dollar reserves, altering the Letter of Credit availability and as such making the overall local market unable to compete for larger ldt units. In Pakistan, the scene indicated many similarities, facing the same type of difficulties while also at the same time being the least competitive destination for some time now within the Indian Sub-Continent. The Indian market, despite the excess volatility in local steel prices, when compared with the other main Indian Sub-Continent Recyclers, may well have prevailed as the most stable market in the near term (at least)”.

Meanwhile, GMS , the world’s leading cash buyer of ships said in its weekly report that “as the ship recycling sector continues to try and adjust to these new lower realities on price, in addition to adhering to new regulations on L/C limits amidst a dire shortage of U.S. Dollars foreign exchange / reserves in both Pakistan and Bangladesh, the industry is certainly going through an uncertain period. This week, the Bangladeshi government introduced new limits to cap the outgoing volume of U.S. Dollars for ‘essential’ purchases only – raising question marks about higher priced vessels for recycling purchases in the foreseeable future. As such, the government announced that any L/C over USD 5 million has to be approved by the Central State Bank for opening, with the Bangladeshi Taka struggling to such a worrying extent of late.

Source: GMS,Inc

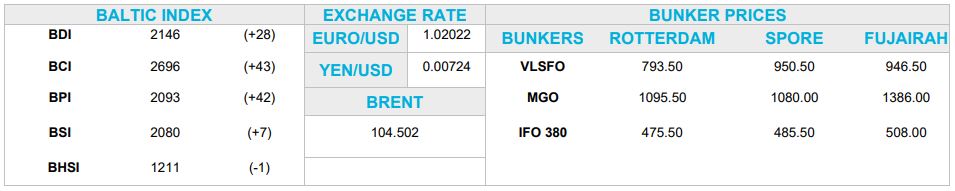

Unfortunately, the currency situation is no better elsewhere as we are witnessing fresh historical lows by the day in all of the major recycling destinations on their respective currencies against the U.S. Dollar, and there have been elevated fears across these locations that international trade may eventually start driving domestic inflation up as the U.S. Dollar continues to strengthen rapidly. Keeping things in check is the fact there are very few new units to work on, now that the tanker chartering market is firming further and this may give the recycling markets, some time to settle and stabilize before fresh units are proposed to Recyclers once again come Q4. While Pakistan has registered a massive drop in local steel plate prices this week, India remains the most stable of the sub-continent markets despite the extreme volatility on Indian plate prices seen on a near daily basis and similar worrying currency depreciation is leaving Alang Recyclers confused and nervous on any firm offers moving forward. On the West End, Turkish plates take another tumble this week as even the currency – like all the major recycling locations – continues its steady slow descent to oblivion”, GMS concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide