Can U.S. LNG exports meet European demand?

July 28, 2022 GENERAL

The Council of the EU said today that, in an effort to increase EU security of energy supply, member states have reached a political agreement on a voluntary reduction of natural gas demand by 15% this winter. The Council regulation also foresees the possibility to trigger a “Union alert” on security of supply, in which case the gas demand reduction would become mandatory.

“The purpose of the gas demand reduction is to make savings ahead of winter in order to prepare for possible disruptions of gas supplies from Russia that is continuously using energy supplies as a weapon,” says the Council.

As the EU seeks to wean itself from dependency on Russian natural gas, U.S. LNG exporters have been major beneficiaries. Even if the EU succeeds in meeting the goal of a 15% reduction in demand, that is not likely to change.

The U.S. Energy Information Administration (EIA) says that United States became the world’s largest liquefied natural gas (LNG) exporter during the first half of 2022. Most U.S. LNG exports went to the EU and the U.K. during the first five months of this year, accounting for 71%, or 8.2 billion cubic feet per day (Bcf/d), of the total U.S. LNG exports. The U.S. provided 47% of the 14.8 Bcf/d of Europe’s total LNG imports, followed by Qatar at 15%, Russia at 14%, and four African countries combined at 17%.

That 14% figure for Russia is more significant than it might appear, because Russia accounts for some 40% of German natural gas consumption. Germany’s ability to substitute LNG imports for that Russian gas is hampered by the fact that that it currently has no LNG import terminals. As we reported earlier, since Russia’s invasion of Ukraine, Germany has been ramping up its plans to deploy floating LNG import terminals (FSRUs). Now, reports S&P Global, four are planned along with two permanent onshore sites, with the FSRUs able to be deployed much more quickly than the onshore facilities. Germany’s economy ministry is hopeful it can begin operations at two FSRUs — one at Wilhelmshaven and one at Brunsbuttel — before the end of 2022

Will U.S. LNG supply be available to meet the demands of those new terminals?

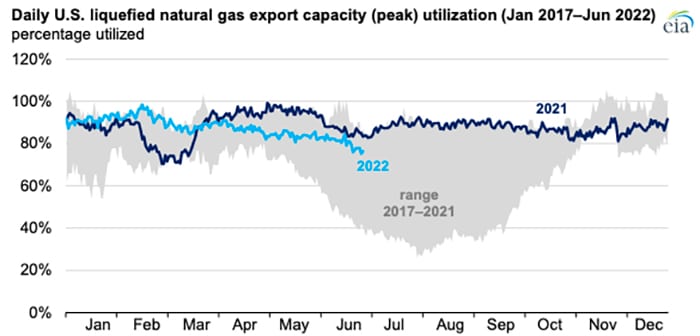

Compared with the second half of 2021, reports EIA, U.S. LNG exports increased by 12% in the first half of 2022, averaging 11.2 billion cubic feet per day (Bcf/d). According to EIA estimates, installed U.S. LNG export capacity has expanded by 1.9 Bcf/d nominal (2.1 Bcf/d peak) since November 2021. The capacity additions included a sixth train at the Sabine Pass LNG, 18 new mid-scale liquefaction trains at the Calcasieu Pass LNG, and increased LNG production capacity at Sabine Pass and Corpus Christi LNG facilities. As of July 2022, EIA estimates that U.S. LNG liquefaction capacity averaged 11.4 Bcf/d, with a shorter-term peak capacity of 13.9 Bcf/d.

International natural gas and LNG prices hit record highs in the last quarter of 2021 and first half of 2022. Prices at the Title Transfer Facility (TTF) in the Netherlands have been trading at record highs since October 2021. TTF averaged $30.94 per million British thermal units (MMBtu) during the first half of 2022. LNG spot prices in Asia have also been high, averaging $29.50/MMBtu during the same period.

In June, the United States exported 11% less LNG than the 11.4 Bcf/d average exports during the first five months of 2022, mainly as a result of an unplanned outage at the Freeport LNG export facility. Freeport LNG is expected to resume partial liquefaction operations in early October 2022.

Utilization of the peak capacity at the seven U.S. LNG export facilities averaged 87% during the first half of 2022, mainly before the Freeport LNG outage, which is similar to the utilization on average during 2021.

Source: https://www.marinelog.com/legal-safety/shipping/markets/can-u-s-lng-exports-meet-european-demand/