Newbuilding Market Activity on the Rise

September 8, 2022 GENERAL

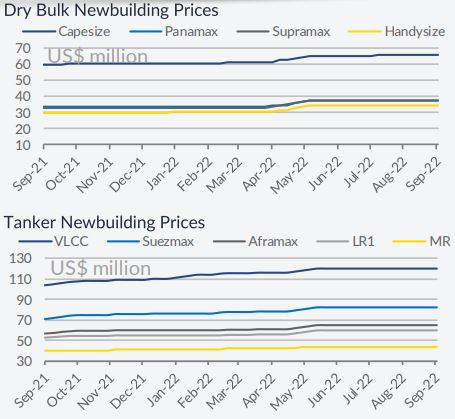

Orders for dry bulk newbuildings have appeared on the market yet again this past week, despite the lackluster state of the freight market. In its latest weekly report, shipbroker Allied Shipbroking said that “the newbuilding market resumed on a relatively modest mode for yet another week, according to the flow of fresh projects being reported as per the below table. More specifically, in the dry bulk sector, new orders appeared in the market yet again (skewed, however, towards medium to smaller size segments), despite somehow the considerable pressure being present in freight numbers for a prolonged period now. Given though that buying interest is sustained robust, we can anticipate many strong projects being pushed forward, especially as we progress towards the final part of the year. In the tanker sector, things did not prevail so vivid. That can be seen seemingly as disconnected at this point, given the incremental recovery in terms of freight earnings that has taken place for many months now. On the other hand, this does not necessarily reflect the general appetite and positive sentiment surrounding this particular market for the time being. All-in-all, given also the market’s state of the other main sectors, we can expect a rather fervent new order market for the upcoming period.

In a separate report, shipbroker Banchero Costa said that “on bulkers Polish Steamship added 4 x 37,000 dwt Lakers at Dalian who ordered the construction to sister yard Shanhaiguan. Deliveries expected at the end of 2025. Dalian Shipbuliding got an order from CITIC Leasing for the construction of 5 x 65,000 dwt Ultramax, deliveries will be during 2025. Doun Kisen Japan went to Jiangmen for the construction of 2 + 2 x 40,000 dwt Bulkers, deliveries at the end of 2025.

Hyundai Mipo received an order from undisclosed Owner to build 2 x 45,000 cbm LPG for delivery at end 2024 and beginning 2025, price around $69mln per unit”.

Meanwhile, in the S&P market, Allied Shipbroking said that “on the dry bulk side, things continued on a relatively sluggish tone for yet another week, given the limited number of units changing hands. Thinking about the recent trend from the side of earnings, this came hardly as disconnected. At the same time, asset prices levels are under pressure as well, widening the bid-ask spread in the SnP market. At this point, we can anticipate a more volatile market prevailing, skewing significantly transaction volumes periodically. On the tanker side, it is rather apparent that things have moved on a stronger trajectory for some time now, given the good activity levels being noted in the market. Notwithstanding this, as of the past week, a small step back took place, according to the considerable lower number of vessels being reported as sold. All-in-all, given the recent momentum in terms of earnings, coupled with the general positive attitude surrounding this market for some time now, we can vision for a relatively fervent SnP market for the upcoming period”.

Banchero Costa added on the S&P Market that “during the week the dry secondhand market was quiet with most of the active players waiting for further developments in the charter market. C. of Panagea were reported to be behind the purchase of Clarke Quay 55,000 dwt built 2010 by Hyndai Vinashin at $17.1mln. A Japanese controlled Handysize, the Malto Hope 28,000 dwt built 2013 by Imabari (BWTS fittedand log fitted) was rumored sold at $13.6mln. In the tanker market some strong appetite for product carriers was clearly spotted. C. of Tufton purchased 2 x ECO MRs Alkaios and Archon around 50,000 dwt built 2016 by Samsung for $36.5mln each. Two 16 years old MRs fitted with ice class 1A Super, the Gotland Carolina 53,000 dwt built 2006 by GSI and the FSL Singapore 47,000 dwt built 2006 by HMD were sold respectively at $18.5mln and $18mln. A modern VLCC, the G Dream 300,000 dwt built 2022 by Hyundai (Scrubber fitted) was sold to Korean buyers at $108mln”.

Nikos Roussanoglou, Hellenic Shipping News Worldwide