About 90% of global trade moves in the approximately 51,000 ships composing the world fleet. In the meantime, the insatiable demand for the fuel that drives maritime global trade is estimated at 2.1 billion barrels (88.2 billion gallons) annually, or 244 million gallons per day.

The noxious emissions, largely sulfur oxides, as well as nitrous oxides and particulate matter, have become a major environmental concern and have been proven to adversely affect global health as they’re discharged into the atmosphere. According to a Goldman-Sachs study, burning standard bunker fuel (Heavy Fuel Oil or HFO) accounts for almost 90% of a sulfur emissions globally, with the largest 15 vessels producing more sulfur than the combined total of all the world’s automobiles.

The International Maritime Organization (IMO) regulations limiting sulfur content of bunker fuel to 0.5% (down from 3.5%) will take effect on January 1, 2020. A small portion of the 51,000 ships in the global fleet already burn compliant fuel, but the remainder will have only four viable options, including one temporary “hall pass” to comply with the law: convert to low-sulfur (e.g., MGO, VLSFO, diesel) or a blend of HFO and low-sulfur that meets the emission standards; install expensive scrubbers and continue to burn HFO, the cheapest grade of fuel; convert to LNG by replacing HFO-burning ships with new LNG vessels; or obtain waivers/non-compliance. For the latter, IMO-2020 provides waivers in a situation where compliant fuel is not available (ships would be required to present a record of the actions taken to attempt to achieve compliance).

Goldman Sachs estimates that the overall impact on consumers in 2020 could be as much as $240 billion, as the added costs cascade across global supply chains, adding approximately $40 billion in increased shipping costs. “This is the largest regulatory change in the oil space ever, and it will have a massive effect far outside of shipping,” says Svelland Capital portfolio manager Kenneth Tveter.

Analysis by the commercial maritime and refining industries indicate about 84 million gallons/day of shipping fuel will transition to low-sulfur alternatives, with some estimates reaching as high as 168 million gallons/day. This tectonic shift means significant additional demand for middle distillates, the fraction of the refined barrel that includes ultra-low-sulfur diesel for truck and rail freight, as well as domestic barge operations.

One strategy, first deployed on a significant scale during the excess capacity of the last downturn, was slow steaming. It saved in fuel cost and used up a portion of the idle capacity, filling out vessel strings that needed more ships due to slower speeds. With operating costs such a vital element for vessel owners, slow steaming and super-slow steaming will invariably arise again. The impact on cost is undeniable, but the lengthening of supply chain lead-times will prove problematic.

This will drive further examination of alternative supply sourcing (i.e., near-shoring or on-shoring.) For supply chain professionals, this is a bit like navigating into a traffic circle in the dark, in the rain, with no lights and trying to find the right exit. Derek Leathers, CEO of national trucker Werner Enterprises posed an insightful question: “Does this do anything broader, for example, to impact near-shoring versus off-shoring? Will it tip the balance?”

The new world order will produce a significant ripple effect, especially when combined with rising labor costs in China, increasing tariffs and longer cycle times. A significant shift in manufacturing to more favorable total cost of ownership (TCO) options will be on the table. Planning for potential impacts and outcomes can’t start soon enough.

The fallout

There is little question that costs will rise: The key question is where the hammer will fall and who will bear the additional cost.

The world’s two biggest container shipping lines—Denmark’s Maersk and Swiss headquartered MSC—say that they face annual extra costs of more than $2 billion each. In the meantime, 25 logistics company executives told Reuters recently that they would pass along any IMO-related costs, such as ship upgrades or more expensive fuel, to customers.

But that’s not all, as the ripple effect is predicted to wash ashore in North America and affect domestic land transportation. While IMO rules don’t apply to domestic modes, they will face new competition from ships for low-sulfur fuel. This is expected to raise the cost of diesel fuel and much as 100% and also affect availability of supply in certain key markets. In summary, we can expect large-scale disruptions in global supply chains as the upheaval in fuel markets takes root and carriers scramble to comply.

Fuel availability will be more challenging under the new rules because blend specs and compatibility remain non-standardized. “At the moment, no one knows which types of fuels will be available at what price, specification or in what quantity,” says Esteban Poulsson of the International Chamber of Shipping. “We could be faced with an unholy mess with ships and cargo stuck in port.”

A reasonable hypothesis is this: All responsible marine vessel operators will be compliant with the IMO-2020 regulations. Some will convert—as some already have—to distillate fuels. Some—estimates say less than 5%—will install scrubbers. Some will resort to HFO/low-sulfur blends. Some will replace aging vessels with LNG-fueled ships.

The net effect will be a surge in demand for distillate fuels as both a source for burning directly and for blending. Refining capacity will not keep up with demand, leading to rising prices for diesel fuel in major markets, like North America.

“Rarely do you see such a potentially massive disruption,” says John Kartsonas, managing partner of Breakwave Advisors. “Delays, a reduced active fleet supply, slow steaming and port congestion can push freight rates to decade highs—and beyond.”

Regardless of the magnitude this change will have, and its ripple effect along the supply chain, it should be viewed seriously by all modes and equally so by those who buy transportation services from these carriers.

North American domestic impact

Predictions are that the wholesale conversion of the ocean-going vessel fleet will significantly increase the demand and competition for fuels used by other modes, with a consequential rise in price—some estimates say as high as 100% increases—and possible constriction of availability.

We were curious about how shippers viewed IMO-2020: Was it high on their radar or buried in the back-scatter? Logistics Management partnered with Breakthrough, a leading transportation energy management firm, in creating a survey to assess the attitudes and readiness of shippers to cope with the impending changes:

More than 90% of the respondents have little or no awareness or knowledge of IMO and the impending regulations, and 80% have done no analysis or forecasting relating to impact on their domestic transportation cost. While the IMO sulfur cap was announced more than 10 years ago, vessel operators said little or nothing to their customers until recently (Q4, 2018). This gave a false sense of security, even to those who have been actively monitoring progress.

Our going-in presumption was, for North American-centric shippers (meaning those spending the bulk of their transportation dollars on truck, rail and barge freight), the level of awareness was not high and the impact not viewed as relevant or of great magnitude.

Bolstering the survey, we interviewed a cross-section of senior-level executives from the ocean, rail, truck and shipper communities, as well as several from the refining and energy markets. A consistent theme was people were “generally aware” of the new IMO-2020 regulations, but had not done any significant analysis to assess the effect on their business.

BNSF Railway burns more fuel than anyone in North America, with the exception of the U.S. Navy. Railroad veteran Matt Rose shepherded BNSF through a drastic rise in fuel costs during the past 20 years. “Fuel went from about $770 million in 2000 to a peak of $4.6 billion,” he said.

BNSF Railway burns more fuel than anyone in North America, with the exception of the U.S. Navy. Railroad veteran Matt Rose shepherded BNSF through a drastic rise in fuel costs during the past 20 years. “Fuel went from about $770 million in 2000 to a peak of $4.6 billion,” he said.

“At one point, fuel was 10% of operating cost, and at its peak it equaled labor cost at 32%,” adds Rose. “Railroads will have to make choices on fuel for the longer term. Going to LNG is billions of dollars in infrastructure and equipment cost. The net price of fuel would have to go up $0.75 to $1.00 per gallon before it would drive a major shift.”

While a 50% increase in the cost of diesel would achieve this, the timing and capital to convert would be large in scale and likely need to extend to most, if not all, the Class I railroads, due to interoperability of equipment.

Derek Leathers runs one of the nation’s largest motor carriers. As CEO of Werner Enterprises, Leathers has his eye on the ball. “We very much have this on our roadmap and have discussed at the board level. It will put more demand on refining capacity, which will have more of an impact in our space. Diesel will have more homes to go to, so our best response is to push the envelope on MPG.”

Source: logisticsmgmt

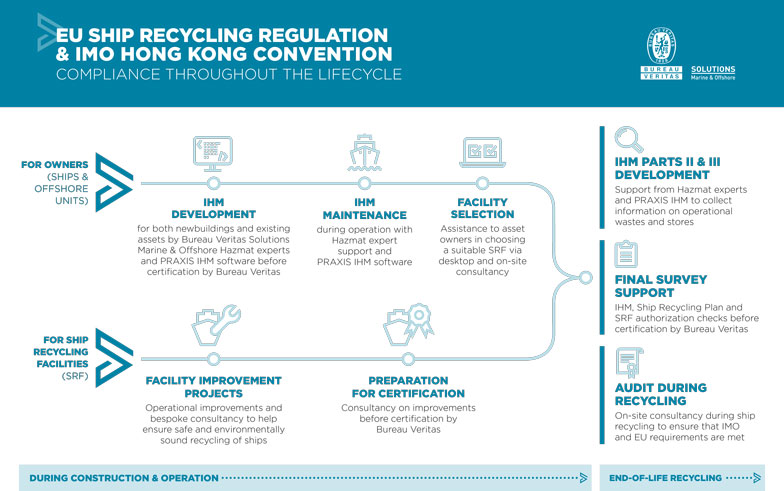

IHM Life Cycle Solution we provide a turnkey IHM (Inventory of Hazardous Materials) / Green Passport solution for shipowners that has been approved by DNV GL, ABS, Lloyd’s Register, BV, Class NK, RINA and Korean Register.

IHM Life Cycle Solution we provide a turnkey IHM (Inventory of Hazardous Materials) / Green Passport solution for shipowners that has been approved by DNV GL, ABS, Lloyd’s Register, BV, Class NK, RINA and Korean Register.