The chief officer of a Chinese tanker will be given the International Maritime Organization award for exceptional bravery at sea for his efforts to rescue two individuals from a liferaft during severe weather last year.

Bo Xu, a Chinese national, was nominated for the award by China and impressed judges with his heroism in the rescue, going as far jumping into the freezing water to help save the two survivors.

The IMO Award for Exceptional Bravery at Sea is the IMO’s highest honor for bravery.

Bo Xu served as Chief Officer of the Chinese oil tanker Jian Qiao 502 on the morning of December 12, 2021, when they were alerted to a sinking cargo ship approximately 30 nautical miles northeast of Zhifu Bay and changed course to render assistance.

After one and a half hours of an exhaustive search, Xu spotted a drifting liferaft filled with seawater and carrying two survivors. The Jian Qiao 502 headed for the raft and the crew quickly realized that both survivors were too weak to securely tie a rope to themselves.

It was at that point that Xu, without hesitation, jumped into the freezing waters and swam relentlessly towards the raft, battling high waves and strong currents. After several attempts, he reached and pulled himself to the raft and tied the ropes to the survivors, who were then successfully transferred to the deck with the help of other crew members.

Upon his return to the ship, Xu immediately performed emergency resuscitation on both survivors, despite fatigue and cold. Unfortunately, only one of the victims survived.

Chief Officer Bo Xu will be presented with award by the IMO Secretary?General at the IMO Awards Ceremony on November 2, 2022, during the 106th meeting of the IMO Maritime Safety Committee (2-11 November).

Another five individuals or sets of nominees will receive certificates of commendation for their acts of bravery, while a further six will receive letters of commendation. Details of each are below.

In total, 41 nominations were received for the 2022 award from 17 Member States and two non-governmental organizations in consultative status with IMO.

Certificates of Commendation

The Council agreed to award certificates of commendation to:

The crew of SAR helicopter Rescue Cyclone Victor, Flotilla 33F, Lanvéoc Naval Air Base, French Navy, nominated by France, for the rescue in severe weather conditions and heavy seas of the entire crew of the sailing vessel Don Quijote, which was badly damaged.

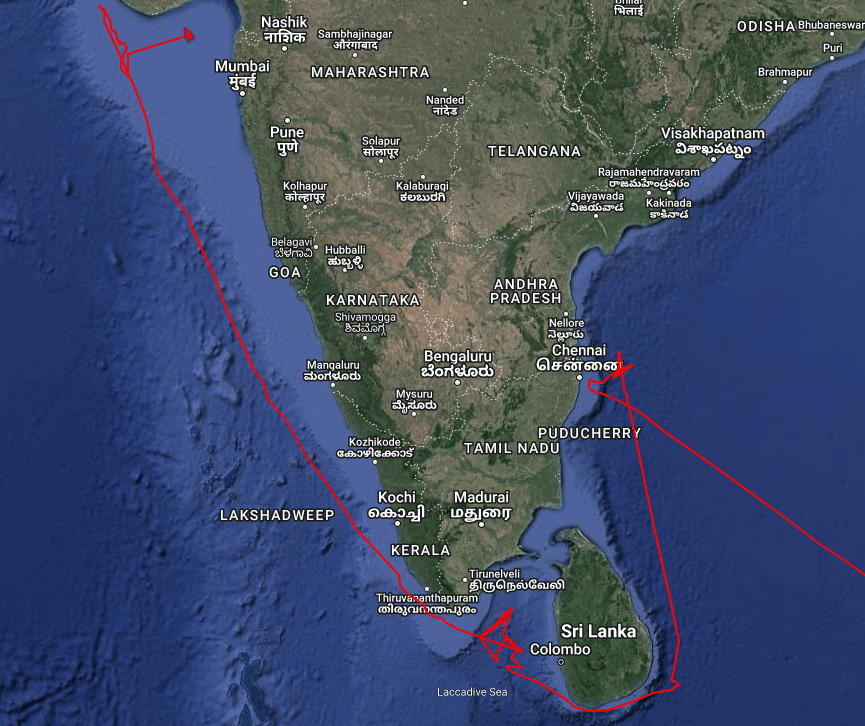

The crews of Indian Naval vessels INS Kochi and INS Kolkata, as well as those of tug/supply vessel Greatship Ahalya, for the rescue of 261 personnel (of which there were 18 casualties) on board the accommodation barge P-305, following its collision with an oil rig during cyclone Tauktae.

The crew of the fishing vessel Fukuseki-maru No.15, nominated by Japan, for the successful rescue of all 20 lives onboard the half?sunken fishing vessel Bandar Nelayan 188.

Three crews of the Coast Guard Air Station Cape Cod, MA, United States Coast Guard; three crews of the 413 Transport and Rescue Squadron, Greenwood NS, Royal Canadian Air Force; and the crew of the CGCC Cape Roger, Canadian Coast Guard, nominated by the United States, for the international rescue operation of all 31 crew members of the fishing vessel Atlantic Destiny, which was on fire, unpowered, flooding and violently pitching and rolling.

Aviation Survival Technician Second Class Juan Espinosa Gomez, Coast Guard Air Station Sitka, Alaska, United States Coast Guard, nominated by the United States, for the rescue of a mariner of the sailing vessel Ananda, amidst heavy seas and limited visibility caused by a powerful Alaskan storm.

Letters of commendation

Letters of commendation will be sent to:

The crew of rescue helicopter B-7309, Beihai Rescue Bureau, nominated by China, for the search and rescue operation of five fishers of the capsized fishing vessel Liao Zhuang Yu 65558.

The crew of the fishing vessel Zhe Yu Yu 82085, nominated by China, for rescuing five surviving fishers of the sinking vessel Shen Lian Cheng 707.

The firefighter of the Hazardous Environment Intervention Group (GRIMP), Departmental Fire and Rescue Service of Reunion (SDIS 974), nominated by France, for his actions during the co-ordinated rescue of 11 crew members of the grounded tanker Tresta Star.

Captain Kakha Bezhanidze, Master of the M/T Elan Vital, nominated by Georgia, for the co?ordinated search and rescue operation of 10 survivors found in three separate life rafts after the sinking of the M/T Suvari H.

Aviation Survival Technician First Class Newsward K. Marfil, Coast Guard Air Station Barbers Point, Hawaii, United States Coast Guard, nominated by the United States, for the rescue of two pilots forced to ditch their cargo aircraft into the Pacific Ocean.

Mr. Nguyen Van Hoa, Leader of the Anti-Drugs and Crime Team, Tan Thanh Border Guard Post, Provincial Border Guard Command of Binh Thuan, nominated by Viet Nam, for rescuing a swimmer swept away by fast-flowing currents.

Source: https://gcaptain.com/chinese-chief-officer-to-received-imo-bravery-award/