At the moment, LNG as a fuel is dominating the orderbook of larger ships. Data from DNV shows that of the 1,046 ships on order with alternative fuels, 167 are LNG-fuelled LNG carriers, and 367 are LNG-fuelled ships of other types.

The challenge with LNG lies in the occurrence of the ‘methane slip’, the unburned fuel emitted from dual fuel internal combustion engines on ships, as well as the methane leakage that happens throughout the LNG supply chain. Various studies have pointed out that these spillages result in higher well-to-wake (WTW) CO2e emissions from ships using LNG compared with conventional marine fuels.

Therefore, the uptake of LNG as a ‘climate-friendly’ fuel for the maritime industry hinges on the assumption that ships can switch to bio and e-LNG (renewable LNG) in the future, cutting greenhouse gas (GHG) emissions.

However, for this to happen, there must be enough renewable LNG to meet future demand and using it must result in a substantial reduction in GHG emissions on a life-cycle basis compared to fossil LNG, as indicated in the recent report by the International Council on Clean Transportation (ICCT).

ICCT’s report focuses on ships trading within the European Union. It predicts a tripling demand for LNG as marine fuel between 2019 and 2030, based on trends in fuel consumption. It also estimates that renewable LNG will cost seven times more than fossil LNG in 2030 and, therefore, subsidies or other policies would be needed to encourage its use.

It dives into three possible scenarios until 2030 in the EU with governmental subsidies supporting the use of renewable LNG.

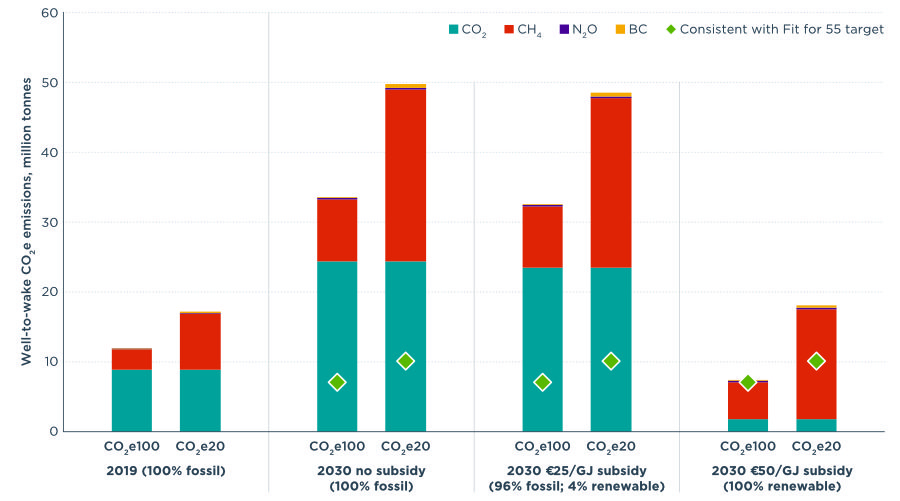

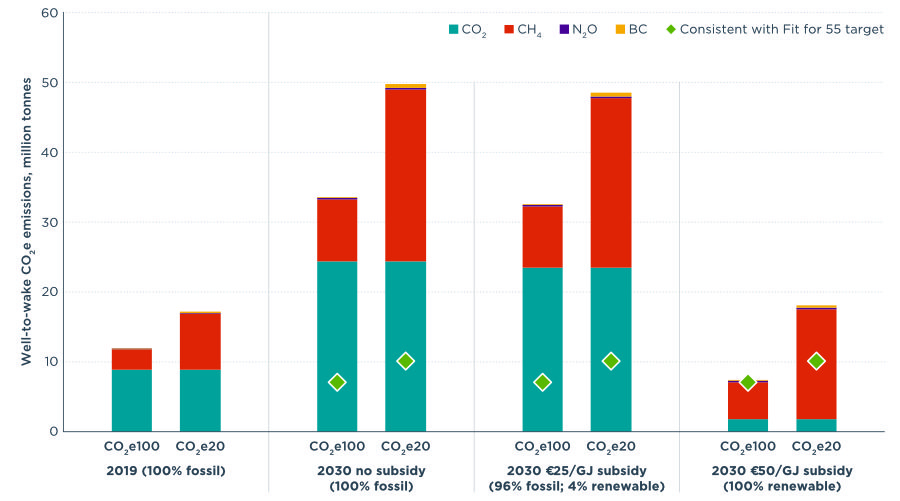

Offering no subsidy means that 2030 LNG demand would be met using 100% fossil LNG, which would result in a tripling of WTW GHG emissions from LNG-fueled ships compared to the 2019 level.

With a subsidy of 25 euros per gigajoule (€25/GJ), which is the current midrange level of EU policy support for grid-injected biomethane and is equivalent to €1,200 per tonne of LNG, only 4% of LNG demand would be met with renewable LNG and WTW GHG emissions would approximately triple from 2019 levels.

Only LNG made using inexpensive landfill gas would be cost-competitive with fossil LNG in 2030 and this feedstock is in limited supply, the study shows.

Doubling the subsidy to €50/GJ would enable the use of 100% renewable LNG because it would create price parity between more expensive LNG biofuels made from agricultural residues as well as e-LNG. This level of price support would require annual public expenditures of €17.8 billion in 2030, the council noted.

The figure below compares a scenario in which ships use 100% renewable LNG in 2030 (far right, representing a €50 per gigajoule subsidy) to emissions from using 100% fossil in 2019 (far left).

“For renewable LNG to significantly contribute to achieving climate goals, methane slip from marine engines needs to be virtually eliminated and methane leaks upstream need to be greatly reduced. Additionally, methane leaks from onboard fuel tanks and cargo tanks, which researchers are still working to adequately quantify, would need to be near zero. It is important for policymakers and stakeholders to understand that other fuels, including synthetic diesel and green methanol, could offer low life-cycle emissions without the methane problem,” ICCT said.

“Synthetic diesel and green methanol have production costs and technical constraints similar to renewable LNG, but these liquid fuels are easier to store onboard than LNG and could be supplied using existing distribution networks. Synthetic diesel can be used in conventional marine engines or dual fuel engines, including those on existing LNG-fueled ships, and methanol can be used in new or modified dual fuel engines.”

What is more, at the moment there are no globally recognised methods for measuring methane slip – with a lack of available data and tools contributing to the issue.

To address the problem, ICCT launched the FUgitive Methane Emissions from Ships (FUMES) project to quantify methane emissions from LNG-fueled ships. Using in-stack continuous emissions monitoring, drones, and helicopters, the project will examine and quantify methane emissions from ships fueled by LNG under a variety of real-world operating conditions.

Industry majors who have been vocal proponents of LNG for their own ships, including Shell and Mediterranean Shipping Company (MSC), have launched a coalition targeting technology solutions for the maritime industry to measure and manage methane emissions.

In its first year, the Methane Abatement in Maritime (MAM) Innovation Initiative plans to identify and pilot new technologies to monitor and reduce ‘methane slip’ from vessels fuelled by LNG.

The initiative will also look into the ways of encouraging ship owners and operators to adopt proven abatement technology at scale.

Source: https://www.offshore-energy.biz/icct-for-renewable-lng-to-make-climate-sense-methane-slip-must-be-eliminated/