Standardising and harmonising electronic ship to shore communication for reporting purposes was high on the agenda at the International Maritime Organization’s (IMO) virtual Facilitation Committee (FAL) meeting held from 1-7 June 2021 (FAL 45).

One of the outcomes from the IMO meeting in the Facilitation Committee (FAL 45) was that a new updated version of the IMO Compendium will soon be issued, based on the most recent adoptions.

The Compendium promotes and supports electronic data exchange conducted using standardized data models and their implementation guidelines.

The IMO Compendium serves as a reference manual for creating and harmonising the systems needed to support transmission, receipt and response of information required for the arrival, stay and departure of the ship, persons and cargo via electronic data exchange.

The current version of the compendium already addresses a number of declarations required according to the Convention on Facilitation of International Maritime Traffic (FAL Convention):

• General Declaration

• Cargo Declaration

• Ship’s Stores Declaration

• Crew’s Effects Declaration

• Crew List

• Passenger List

• Dangerous Goods Manifest

• Security-related information as required under SOLAS regulation XI-2/9.2.2

• Advance Notification for Waste Delivery to Port Reception Facilities; and

• Maritime Declaration of Health.

In addition, the Compendium has been extended to include additional e-business solutions beyond those related to the FAL Convention, such as on port logistic operational data and real time date, to ensure the easy implementation of the IMO Just-In-Time (JIT) concept and maritime certificates.

More data sets are waiting to be included in the model.

“The IMO Compendium changes the way the maritime industry and ports will be communicating. Shipping is entering the digital world, and this change will reduce the administrative burden and increase the efficiency of maritime trade and transport,” says Jeppe Skovbakke Juhl, Manager, Maritime Safety & Security at BIMCO.

The positive news is that the FAL Committee made significant progress in the harmonisation and standardisation of electronic messaging by approving updates to the IMO Reference Data Model, as set out in the IMO Compendium.

“Although the software platforms may differ, the IMO Compendium can ensure that ships and shore will use the same data structure when communicating,” Juhl adds.

“This is a huge step forward for harmonising the machine-to-machine data exchange communication with the shoreside,” Juhl says.

Given the current size of the IMO Reference Data Model, the IMO Compendium will no longer be produced in a Word format, but instead be issued as an Excel file format.

IMO to assess the implementation of electronic data exchange

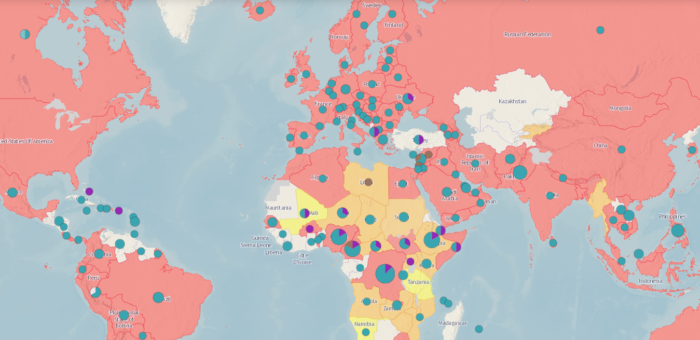

FAL 45 also agreed on another important measure addressing maritime digitalisation by developing guidelines to measure domestic implementation of the FAL convention. The aim of the guidelines is to create a tool to assess the opinion of maritime users about the FAL Convention, checking compliance with the administrative processes established by each national maritime authority and observing how well the maritime single window system is working, among other systems.

Back in 2016, IMO adopted mandatory regulations for electronic data exchange requiring public authorities to establish systems to assist ship clearance processes by April 2019. The aim of the requirements was to encourage the use of the “single window” concept, and to enable all the information required by public authorities in connection with the arrival, stay and departure of ships, persons and cargo, to be submitted via a single portal without duplication.

Although the IMO assessment is voluntary, it may give a much better picture to which degree the national public authorities have implemented the IMO Compendium and the associated IMO Reference Data Model.

Source: BIMCO, By Peter Sand, Chief Shipping Analyst

SOURCE READ THE FULL ARTICLE

BIMCO welcomes updated IMO Compendium to advance electronic data