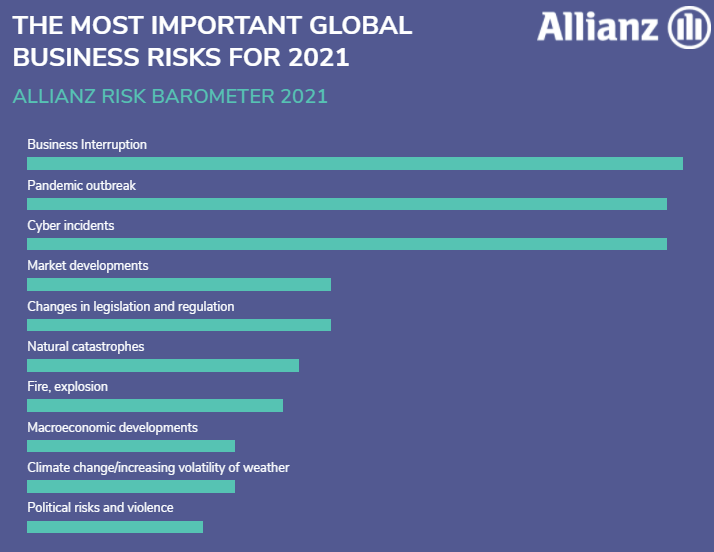

A trio of Covid-19 related risks, inlcuding Business interruption (#1 with 41% responses), Pandemic outbreak (#2 with 40%), and Cyber incidents (#3 with 40%), makes the top three global business risks awaited this year, according to the 10th Allianz Risk Barometer 2021.

The Allianz Risk Barometer is an annual report identifying the top corporate risks for the next 12 months and beyond, based on the insight of more than 2,700 risk management experts from 92 countries and territories.

GET THE SAFETY4SEA IN YOUR INBOX!

The survey focused on large- and small- to mid-size enterprises and respondents were asked to select the industry about which they were particularly knowledgeable and to name up to three risks they believed to be most important.

All of the top three risks – and many of the others in this year’s top 10 – are interlinked, demonstrating the growing vulnerabilities and uncertainty of a highly globalized and connected world, where actions in one place can spread rapidly to have global effects, the report notes.

It is noted that, prior to the pandemic, business interruption had already finished at the top of the Allianz Risk Barometer seven times over the past decade. Meanwhile, cyber risk has regularly ranked in the top three corporate perils in recent years, coming first in 2020.

The pandemic has demonstrated just how vulnerable the world is to unpredictable and extreme events and has highlighted the downside of global production and supply chains,

…the report notes.

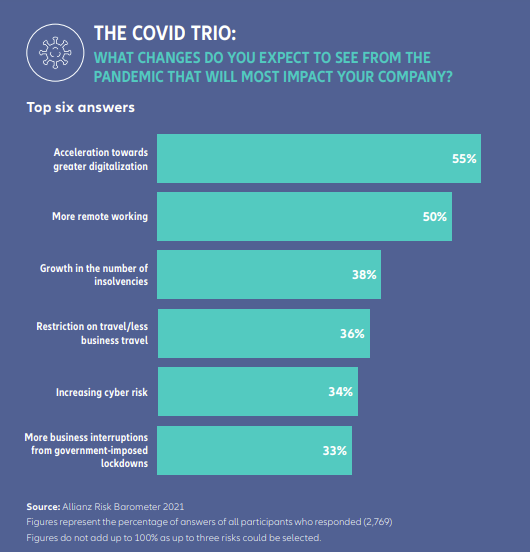

When asked which change caused by the pandemic will most impact businesses, Allianz Risk Barometer respondents cited the acceleration towards greater digitalization, followed by more remote working, growth in the number of insolvencies, restrictions on travel/ less business travel and increasing cyber risk.

The outbreak has also shown that business interruption is highly correlated with many of the risks of most concern to businesses today as identified in the Allianz Risk Barometer, such as natural catastrophes and climate change, political risks and civil unrest, and even rapid changes in markets, in addition to cyber.

The outbreak has also shown that business interruption is highly correlated with many of the risks of most concern to businesses today as identified in the Allianz Risk Barometer, such as natural catastrophes and climate change, political risks and civil unrest, and even rapid changes in markets, in addition to cyber.

A number of the climbers in 2021 – such as market developments, macroeconomic developments and political risks and violence – are in large part a consequence of the coronavirus outbreak. For example, the pandemic was accompanied by civil unrest in the US related to the Black Lives Matter movement, while anti-government protest movements simmer in parts of Latin America, Middle East and Asia, driven by inequality and a lack of democracy.

One of the big lessons learned from the pandemic is that extreme business interruption events are not just theoretical, but a real possibility.

For example, a new strain of Covid-19 even led to the sudden closure of UK ports and borders in late December 2020, coinciding with existing port congestion during the Christmas period and the end of the Brexit transition period. Other potential triggers for large-scale business interruption events in the future could include environmental or natural disasters, further disease outbreaks, a large-scale cyberattack or blackout, or even a solar storm.

The consequences of the pandemic are also likely to heighten business interruption risks in other areas in coming years. Even as the immediate health risks of the pandemic ebb with vaccinations, the accelerated push to digitalization will likely bring new risks, while the economic, societal, and political repercussions of the pandemic could also bring sources of disruption for years to come.

Looking forward, the pandemic shows companies need to prepare for a wider range of business interruption triggers and extreme events than previously. Building greater resilience in supply chains and business models will be critical for managing future exposures.

SOURCE READ THE FULL ARTICLE

https://safety4sea.com/what-to-watch-when-using-tow-ropes/