Tankers: A Tidal Change is in Effect

July 24, 2022 Maritime Safety News

The tanker market is experiencing a structural shift in trading routes, which could have long-standing implications for ship owners. In its latest weekly report, shipbroker Gibson said that “back in March we looked at commercial stock developments for both crude and products in the key trading hubs. Whilst the invasion had just begun and therefore not yet had any impact on inventory levels; stocks were already trending towards historic lows. Now, after 5 months of war and resurgent oil demand, stocks have come under further pressure and conceivably, are expected to face additional tightness as sanctions against Russia ramp up towards the year end and into early 2023”.

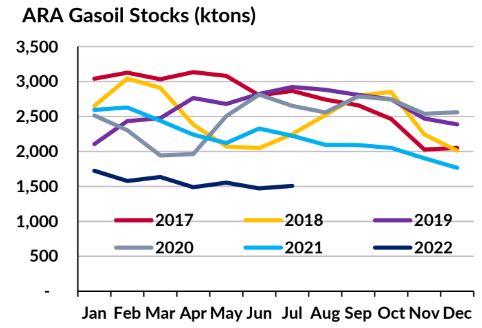

According to Gibson, “in Europe, by far the largest destination for Russian oil and products, gasoil/middle distillate stocks have remained near record lows, failing to register any seasonal increase despite higher local refining activity. Typically, storage volumes would rise during summer ahead of increased winter demand; however, without any meaningful increase in inventories in the coming months, Europe will face a precarious position heading into winter, forcing increased volumes of long-haul imports as the refined products import ban takes effect. In contrast to the middle of the barrel, gasoline stocks sit at healthy levels, with the region ramping up refinery output to maximise distillates, gasoline supply has increased as a result, supporting export flows”, the shipbroker concluded.

It added that “across the pond, the picture looks somewhat different. US gasoline stocks sit at a 7-year seasonal low during peak demand season. Whilst storage levels typically draw down this time of year due to high demand, persistent supply tightness is likely to support transatlantic gasoline flows throughout the year. Total distillate inventories tell a similar story. However, whilst supply has risen in the US Gulf towards ‘usual’ levels, the Eastern seaboard is exceptionally tight, which could cause a supply squeeze come winter when demand peaks, necessitating imports from overseas and potentially creating a ‘reverse arbitrage’”.

“In the East, the picture is somewhat mixed. In Singapore, a barometer for the Southeast Asia market, light distillate stocks (primarily gasoline/naphtha) are near record highs for this time of year, yet middle distillate stocks sit close to record lows – a similar picture to Europe, driven by lower exports from China, resurgent regional demand and competition for Middle East exports. Strong regional refining margins should boost volumes later in the year, although volumes from the Middle East may come under pressure as Europe is forced to source alternatives to Russian supplies. Fujairah, the main products hub for the Middle East and East Africa, shows a contrasting picture yet again. Light distillates are in tight supply and close to record lows, whilst middle distillates have risen to healthy levels for this time of year. The hub is expected to grow as a destination for Russian products, making it difficult to call inventory levels in the months ahead”, Gibson said.

“So, what are the implications of these balances on trade flows? Many of these fundamental imbalances have been in place for decades, such as Europe being short of diesel. The difference now is that the deficit will have to be filled from further afield with traders already making plans for post sanctions supplies. These matters will be complicated by uncertainty over how much Russian product can be redirected. If, as claimed by President Bolsanaro, a contract between Brazil and Russia has been agreed, then more US Gulf product is likely to be redirected to Europe. Likewise, we wait to see how many Russian barrels find their way into Africa and Asia. The reallocation of flows is likely to be accentuated by low inventories, with very little supply cushion to help manage the disruption”, Gibson concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide