📘 Maritime Electronic Record Books (ERBs): The Future of ShipRecordkeeping

Are you ready for the digital transformation of maritime compliance? Maritime Electronic Record Books (ERBs) are now essential tools for modern fleets—improving accuracy, reducing administrative burden, and ensuring regulatory compliance.

✅ What Are Maritime Electronic Record Books?

Maritime Electronic Record Books (ERBs) are secure digital solutions that replace traditional paper logbooks used onboard ships. They allow ship operators to digitally record entries such as:

With the IMO (International Maritime Organization) and various flag states recognizing and approving the use of electronic record books, digital logs are rapidly becoming industry standard.

🚢 Why Are ERBs Important for Commercial Vessels?

-

Compliance with IMO Resolutions (MEPC.312(74))

-

Flag State approvals (Panama, Liberia, Marshall Islands, etc.)

-

Instant access during Port State Control inspections

-

Time-saving automation

-

Elimination of human error and tampering

🔒 Are Electronic Record Books Compliant and Secure?

Yes. Approved ERBs meet the requirements of IMO’s MARPOL regulations and STCW Convention. They include:

🌍 Transitioning to Digital Logbooks: Is Your Fleet Ready?

The shift to paperless ship operations is no longer optional—it’s a competitive and compliance-driven necessity. Shipowners who adopt maritime electronic record books now will gain:

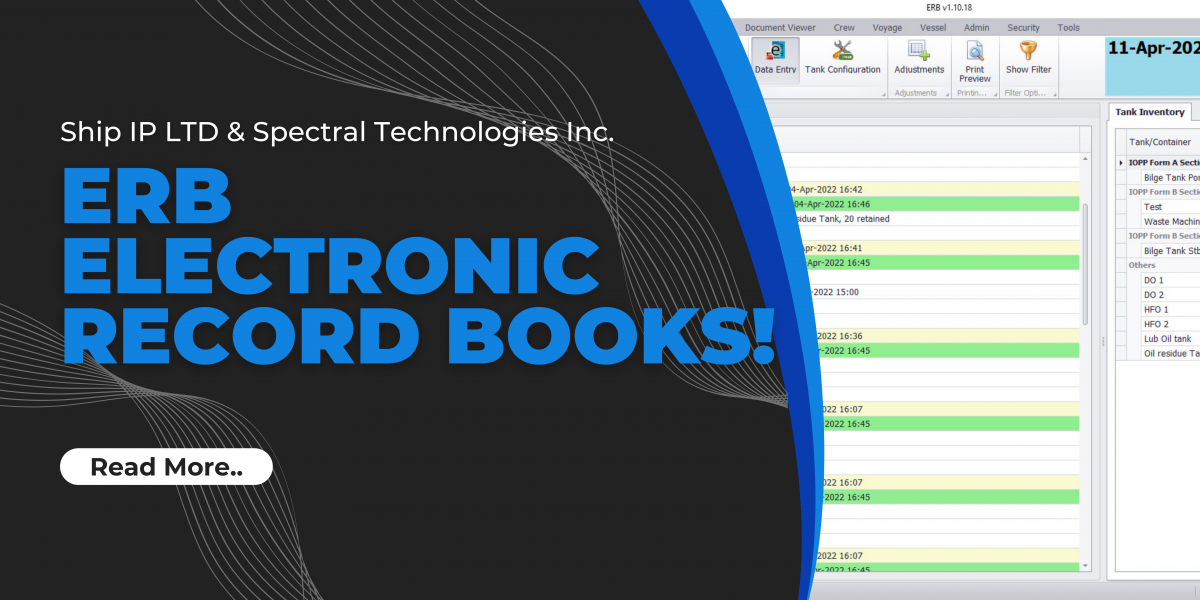

🚀 Introducing CREWExpress ERB by SHIP IP LTD

At SHIP IP LTD, we offer erb, an advanced Maritime Electronic Record Book software that covers:

s

✅ Oil Record Book

✅ Ballast Water Log

✅ Garbage Record Book

✅ Digital Crew Management Integration

CREWExpress is approved, easy-to-use, secure, and built for the modern shipowner.

📞 Contact us today for a free demo and consultation at https://shipip.com/erb-electronic-log-books/

🔎 Frequently Asked Questions (FAQ)

Q: Are maritime electronic record books mandatory?

A: They are not yet mandatory globally, but many flag states and classification societies now accept and encourage their use.

Q: Can I use ERBs on all ships?

A: Yes, ERBs can be installed fleet-wide, depending on your flag state and onboard system compatibility.

Q: What if the internet fails?

A: SHIPIP ERB works offline and syncs securely once the connection is restored.

📈 Final Thoughts

If you’re searching for the best maritime electronic record books, choose a solution that combines compliance, simplicity, and innovation. With ERB by SHIP IP LTD, you future-proof your fleet’s operations and meet global regulatory standards.