Ship Owners Keep Investing in Bigger Ships

July 28, 2022 BIMCO

Ship owners have kept on contracting newbuildings and secondhand vessels, opting for larger tonnage. In its latest weekly report, shipbroker Allied Shipbroking said that “things in the newbuilding market continued on a relatively fair mode for yet another week, given the modest number of fresh projects being pushed forward. In the separate sectors and specifically in the dry bulk one, we saw activity being skewed towards the bigger size segments. Given the recent trends from the side of freight earnings though, this may as well have come as a slight surprise. Moreover, as freight markets appear more volatile as of late, we can expect periodical volatile in new ordering activity as well, especially as we also approach the peak of the summer period. In the tanker market, we witnessed some sort of movement, more towards the MR size segment. On the other hand, as the incremental recovery resumes in terms of freight returns, we can expect more capital being pushed towards this direction. In other sectors, we noticed a single order for up to 3 smaller teu container units”.

In a similar note, shipbroker Banchero Costa added that “activity was quiet last week on tanker and container segment with only some marginal business being concluded. A domestic order was given to CSC Taiwan for a 50.000 dwt MR tanker from local Owner CPC Corporation, no price emerged and delivery end 2024. Korean Owners HMM selected Hyundai Mipo for a fir 3 x 1800 teu container feeder ordered at price of about USD 35.5 mln each. Gas sector’s orderbook continues is escalation, this time Daewoo filling up the columns with an order of 4 x 174.000 cmb divided by Japanese Owners Iino Kaiun and Meiji Kaiun; late deliveries are reported well into 2026 and 2027, no price reported.

In the drybulk sector it was interesting to notice a fresh order for capesizes at Namura for 2 x 180.000 dwt vessels placed by Foremost, for delivery end 2024 and mid 2025 respectively. We understand the contract is backed by long TC to NYK”.

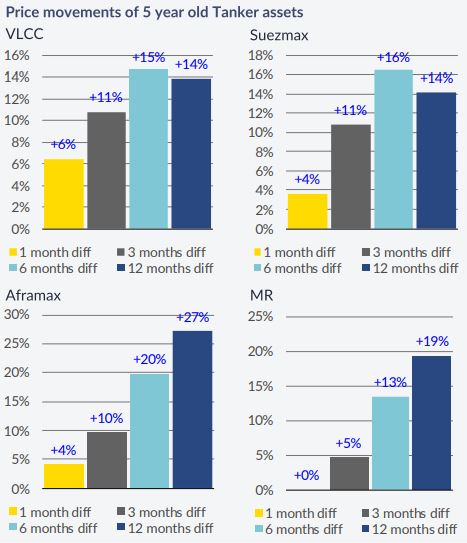

Meanwhile, in the S&P Market, Allied added that “on the dry bulk side, things in the SnP market moved on an uninspiring trajectory as of the past week, given the limited number of vessels changing hands. Thinking about the volatile shifts in freight market’s direction the past few weeks or so, coupled with the fact that we slowly entering the peak of the summer period, this trend of late came with little surprise. On the other hand, given the overall sentiment, we will continue seeing interesting deals being pushed forward. On the tanker side, activity was sustained on a good momentum for yet another week, with numerous transactions appearing in the market as of late. For yet another week though, this was partly due to a vivid MR market and more specifically due to a couple en bloc deals. All-in-all, given that we continue seeing improved market conditions and sentiment, we can expect buying appetite moving accordingly as well in the near term”.

Banchero Costa added that “in the dry bulk sector, after offers were invited on the 14th of July, Chinese controlled Ultramax Dayang Confidence abt 63k blt 2017 Yangzhou Dayang has been sold at USD 30 mill. Last week Soho Mandate abvt 60k blt 2016 DACKS was done at USD 31 mln. COSCO controlled Supramax Shun Xin abt 57k blt 2010 COSCO Zhoushan (SS due 2025; BWTS fitted) has been sold at USD 16.8 mln. In the tanker sector, activity was focused in large crude carriers. Suezmax Dolviken abt 160k blt 2012 Samsung (SS/DD passed) was purchased by c of Advantage Tanker at USD 42.5 mln. Furthermore 4x Aframaxes changed hands during the week.

Elandra Angel abt 115k btl 2009 Samsung (DD passed) at USD 33 mln. Nicholas abt 115k blt 2007 Sasebo at USD 27.7 mln to Chinese buyer. Blue Pride abt 115k blt 2004 Daewoo at USD 23 mln basis prompt dely beginning of August and Songa Coral abt 107k blt 2005 Koyo at USD 25 mln. Two MRs were calling for offers earlier in the week Largo Sun abt 50 k blt 2016 SPP (BWTS fitted) which was sold to Greek buyers at USD 35 mln. Challenge Phoenix abt 48k blt 2007 STX which went always to Greeks at USD 18 mln. The GRAND 50k / 2008 SPP (BWTS fitted) reported sold for low USD 19 mln to Vietnamese Buyer. In comparison the SUNNY BAY 2008 sister was sold couple of weeks back at high USD 17 mln”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide