Tanker Owners Looking Forward to a Rise in Crude Oil Production

August 2, 2021 Maritime Safety News

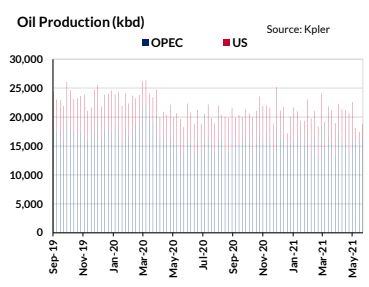

Tanker owners are eagerly awaiting for an increase in crude oil production. Still, according to shipbroker Gibson, “the tighter OPEC keep things today, the greater the potential future rewards from higher US exports could be”. In its latest weekly report, shipbroker Gibson said that “with oil prices racing back up to $75/barrel and the very real prospect of sustained demand rising in the near term, the time to open the taps, you would think would be now. However, as with everything that has happened over the past 18 months, it isn’t as simple as that. OPEC+ have instigated monthly meetings to keep an eagle eye on prices, demand and production. This has allowed them to fine tune its quota system. At the time of writing OPEC+ was yet to reach a cohesive agreement on production volumes for August onwards, although most members supported a monthly increase of 400kb/d”.

According to Gibson, “over in the United States, things are slightly different. The shale producers are keeping output flat and showing considerable restraint on spending despite the rise in current oil prices. Historically, when oil prices rose, the US shale producers would have piled in and increased production. But this time, investors are demanding better financial returns over more volume and energy financiers are shifting their focus to renewables. Shale production over in the US remains below the January 2020 peak of 9.18 m b/d, with production running at around 7.77 m b/d. Baker Hughes highlights that there were 670 US oil drilling rigs then, currently there are around 372. At recent oil prices, we would have expected rig count and production to substantially increase, but there has been restraint not seen at such oil prices before”.

“However, despite the rapid increase in oil prices, OPEC+ still has the upper hand, with around 6 million b/d of spare capacity. The impact of this potential spare capacity is obvious. Despite oil prices being well above breakeven levels for most shale producers, the fear that OPEC+ will reopen the taps has meant that they are much more circumspect when it comes to investment opportunities rather than just chasing market share like they used too. The lack of freely available capital to the shale producers could well hinder the industry in the future. Dutch bank ABN Amro announced that it plans to exit oil and gas lending in North America, after agreeing to sell its $1.5 billion portfolio of loans to investment firms Oaktree Capital Management and Sixth Street Partners. It could only be a matter of time before more banks follow suit. However, most US oil execitves are downplaying the potential for shale to increase rapidly in the near term. Recently Hess chief executive, John Hess estimated that it would take four years for US oil output to get back to pre-Covid levels”, Gibson noted.

The shipbroker concluded that “for the tanker sector, most owners will be grateful for an increase in oil supply, no matter where it comes from. Rising global demand for gasoline, jet fuel and chemicals will eventually require an increase in crude production. For now, OPEC+ seems like the primary source of growth in the short term. However, if crude prices remain firm (or even rise) then it will only be a matter of time before producers in the US are tempted to accelerate production increases. The challenge for OPEC+ is to find the right balance between prices that are acceptable to its membership, but not too attractive to shale producers. For tanker owners however, the tighter OPEC keep things today, the greater the potential future rewards from higher US exports could be”.

Nikos Roussanoglou, Hellenic Shipping News Worldwide

SOURCE READ THE FULL ARTICLE

https://www.hellenicshippingnews.com/tanker-owners-looking-forward-to-a-rise-in-crude-oil-production/