Spanish authorities are examining the sudden disappearance of a 50,789 DWT container ship captain. The vessel reached the Port of Algeciras late last week.

The Algeciras Express set sail from the port of Yalova, located on the Sea of Marmara south of Istanbul, on 30 June. La Guardia Civil de Algeciras reports that on 3 July, four days later, they were informed by the vessel’s first officer that their captain went missing.

The crew members thoroughly searched the vessel and reported that the captain was nowhere to be found.

The ship reached the Port of Algeciras on 7 July, but the authorities ordered the ship to anchor offshore until a new captain joined duty to take over the command of the Algeciras Express. Reports indicated that the port needed a captain to be on the ship to oversee its maneuvering into the dock.

Owned by Seaspan and registered with Liberia, the container ship operates under charter to Hapag-Lloyd. Reports mentioned that Hapag arranged for a Ukraine-based captain to fly to the port and immediately join the vessel. The ship was permitted to proceed toward the dock on 10 July.

Once the ship was alongside, the police boarded it and began interviewing the first officer and the 28-member crew. The police searched the vessel and entered the missing captain’s cabin. Local media reports have indicated that the cabin was in good condition, and the captain had also prepared a navigation plan for 4 July. However, they could not locate any signs of struggle or the captain. Nothing seemed abnormal on the ship.

The relevant Spanish authorities have reported the same to Liberia as it is the flag state for the vessel. They are in touch with the Philippines as the captain was a Philippine citizen. Concerned Spanish authorities have listed the captain as missing.

The Algeciras Express was traveling with a few containers when it arrived but was allowed to get done with its typical container handling on Sunday at the port. On Monday, it was anchored off Algeciras, but later on, it was released by the Spanish authorities and is sailing toward Tanger-Med in Morocco.

Source: https://www.marineinsight.com/shipping-news/captain-of-container-ship-algeciras-express-goes-missing-mysteriously/

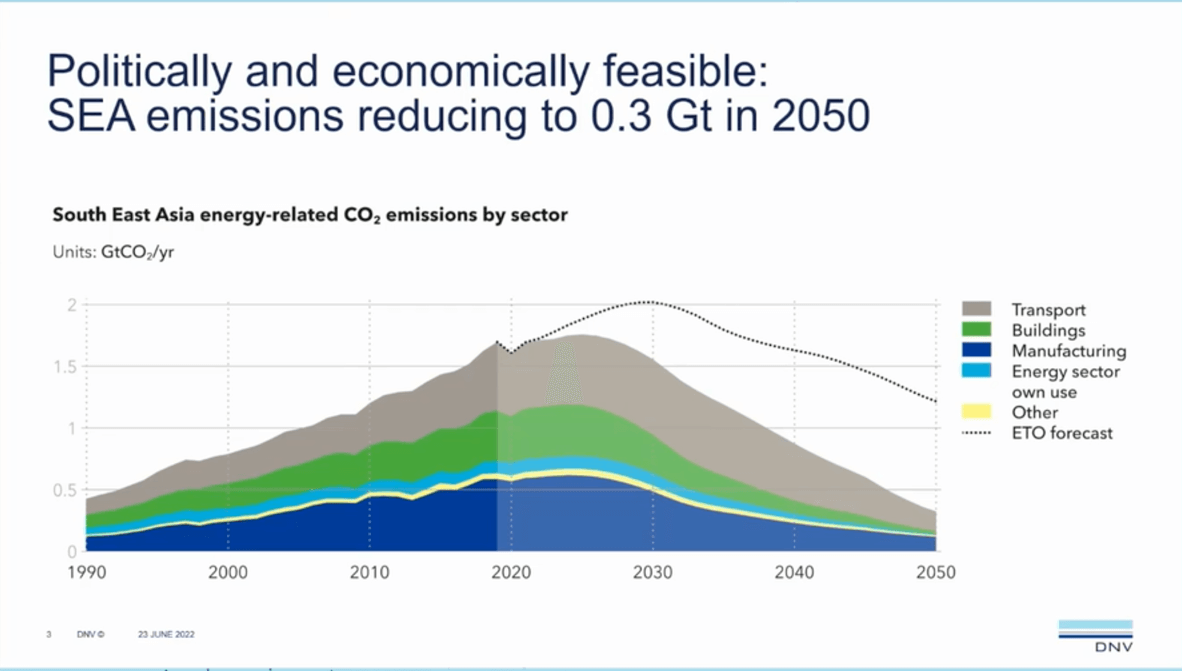

DNV predicts that Southeast Asia can reduce its greenhouse emissions down to 1990s levels by midcentury (DNV)

DNV predicts that Southeast Asia can reduce its greenhouse emissions down to 1990s levels by midcentury (DNV)