(Bloomberg Opinion) – The shipping industry is getting serious about cutting sulfur dioxide emissions. People who live along busy shipping lanes will see health benefits from reduced particulate emissions and a reduction in acid rain when new regulations came into force on Jan. 1. But the sulfur particles help offset some of the warming caused by powering the ships, so the rules may also increase the likelihood that rising sea levels caused by global warming leave those same populations without a home.

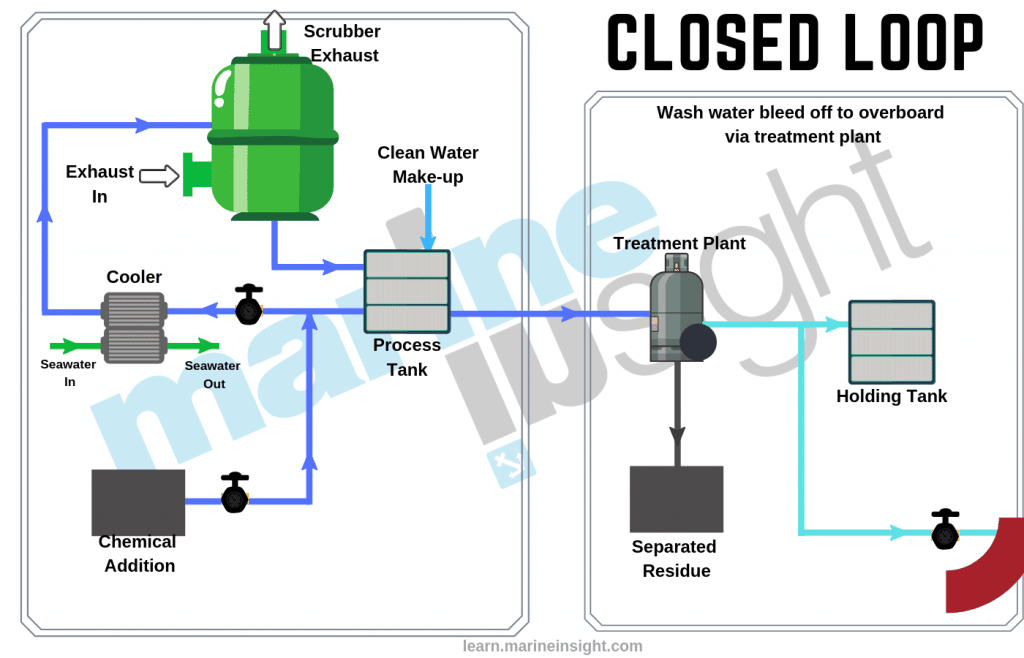

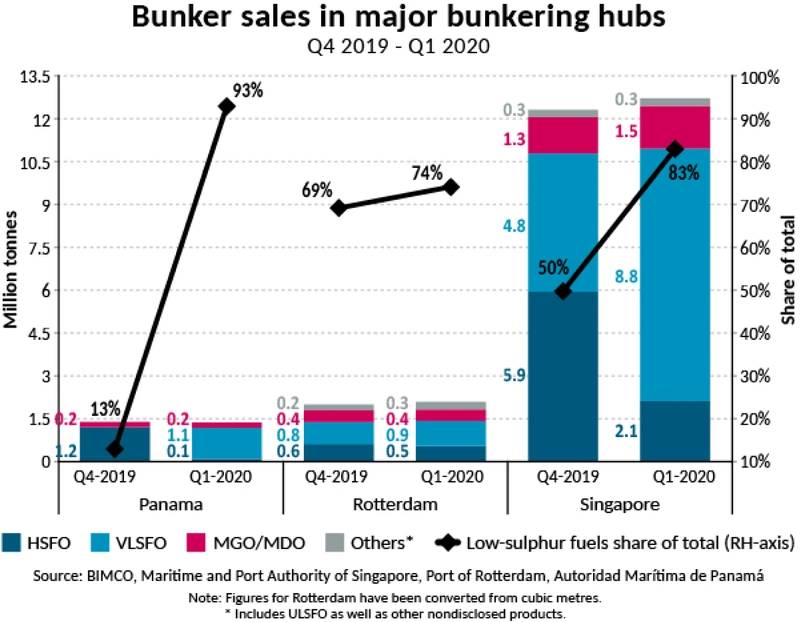

The new regulations from the International Maritime Organization, a United Nations agency responsible for ensuring safe and efficient shipping on clean oceans, allow for two ways of tackling the problem. Either ships must burn fuel with a sulfur content of no more than 0.5%, down from the 3.5% that is currently permitted outside of designated special emission-control areas. Or they must install scrubbers to remove sulfur from their exhaust.

The change targets the public-health impact of shipping, which is estimated to contribute 13% of total sulfur oxide emissions annually. It will slash the amount of sulfur dioxide from ships by 75%. Doing so will dramatically reduce premature deaths resulting from sulfate emissions from ships, according to a paper published in Nature Communications in 2018 by a team of researchers from U.S. institutions and the Finnish Meteorological Institute.

Most of the health benefits will be felt by communities in coastal regions of densely populated countries with busy ports or those on major sea-trade routes, especially in India and China. People living near coastlines in the U.S. or Europe won’t see a difference since ships operating in those areas already face far stricter limits that restrict them to burning fuel with a maximum sulfur level of 0.1%.

But these health benefits may come at a cost of actually worsening shipping’s climate impact. That’s because the sulfates from ships’ exhaust emissions contribute a cooling effect that will be lost with their removal.

Sulfur aerosols from ship exhaust reflect energy back into space. But they also help make clouds brighter, so they reflect more sunlight away from the Earth as well. Mikhail Sofiev, one of the authors of the Nature Communications paper, explained it like this:

Clouds with many small droplets are “whiter” — more reflective — than the clouds with few large droplets. Anthropogenic particles are small and numerous. They attract water and prompt formation of many small cloud droplets – and we get white-top cloud. Fewer sulfate particles reaching the cloud tops will reduce their albedo [ability to reflect] because the cloud droplets will become less numerous, bigger and therefore less reflective.

Most of the cooling effect from ship exhaust comes from this secondary impact on clouds, accounting for about 92% of the total. The new regulations will reduce that cooling impact from the world’s shipping fleet by 81%, according to the study. The net effect of the IMO 2020 rule on the climate impact is to increase the warming effect of all human activities by 3.8%.

Removing the sulfur from ship emissions exposes the climate effects of shipping. As James Corbett, another of the report’s authors, points out, “sulfate aerosols mask climate forcing, they don’t change it.”

The sulfur puzzle is just one piece of IMO’s efforts to clean up an industry that’s crucial to keeping global trade flowing, with more than 80% of global trade carried by sea. The Third IMO GHG Study, published in 2014, estimated that in 2012 international shipping accounted for about 2.2% of all anthropogenic carbon dioxide emissions, and that such emissions could grow by between 50% and 250% by 2050.

In 2018, the London-based group adopted a strategy to reduce greenhouse gas pollution. The goal is to cut the carbon intensity of international shipping “by at least 40% by 2030, pursuing efforts towards 70% by 2050, compared to 2008,” according to the document. It also aims to bring about a peak in total greenhouse gas emissions “as soon as possible” and reduce them by at least 50% by 2050 compared with 2008 levels. The overall emissions target is lower than the carbon intensity goal because the volume of shipping is forecast to increase over the next 30 years.

One proposal to help achieve all of this is to lower fuel consumption by introducing speed limits. Others include technical approaches such as mandatory power limits.

Where sulfur dioxide emissions are concerned, some of the negative climate impact may be offset by a parallel reduction in organic carbon and black carbon particles from ship exhaust, which have strongly warming properties. Low-sulfur fuels contain fewer black carbon particles and scrubbers remove them alongside the sulfur. They also have another important component: They are extremely expensive.

The higher cost of IMO 2020-compliant ship fuel and the fact there is no single worldwide specification for compliant fuel may in and of itself increase the incentive for ship operators and charterers to cut consumption, Corbett argues, thereby reducing CO2 emissions.

Until an industry-wide greenhouse gas strategy is adopted and implemented that may be the best hope we have.