The most awaited regulation of the decade for the maritime industry has been implemented from 1st January 2020. The implementation of 0.5% sulfur cap for marine fuel, popularly known as IMO 2020 will need strict compliance from the crew and shipowners, making it one of the most stringent regulations under MARPOL in the recent times.

Whenever any new regulations are implemented in the maritime industry, the first authorities to ensure ships are complying with them are the port state authorities.

Every port state authority will come onboard ships to check if the shipowners and the crew have done their part in making the new regulation effectively implemented onboard. Failing to do so will ask for hefty fines and even detention.

The IMO 2020 Regulation requires vessels to ensure ships machinery burns the fuel whose exhaust sulphur component by wt percentage is not more than 0.5%.

Needless to say, is extremely critical for the ships’ crews to be familiar with the new regulations, how it can be effectively implemented and all the associated documentation with it so that when a PSC inspector is onboard for checking the compliance, the ship can easily sail to the next port without any remarks or non-compliance.

How ship can prepare for IMO 2020 inspection by PSC?

The most important thing for the ship crew is to understand the requirements clearly. The fuel received onboard the ship will be considered as one of the most important evidence for any inspection.

Hence, with respect to the fuel oil, the crew must:

1. Ensure Bunker delivery note and Fuel Sample is kept onboard

As per the requirement, the BDN to be kept on board ship for three years from the date of issue. The BDN should be accompanied by a Representative Sample of the fuel delivered – the MARPOL Sample.

2. Correct Soundings Record:

Apart from the BDN, the PSC will check the soundings of the tanks where the low sulphur fuel is kept or where the HSFO is kept for ships with exhaust gas scrubber.

Any discrepancies in the value of the sounding may lead to suspicion and further investigation.

Credits: US Navy/Wikipedia.org

Ensure the officer in charge of sounding keeps all the records in place and the volume correction is done appropriately as per the temperature of the oil.

The sounding log books need to updated regularly and signed by the chief engineer and the officer taking the soundings.

Related Read: Fuel Oil Consumption Calculations For Ships: What Seafarers Should Know

3. Fuel Transfer Record:

The ship must keep ready the fuel oil transfer plan for LSFO and HSFO fuel. Along with that, the PSC may ask for a fuel oil line diagram for reference. The tanks dedicated to LSFO must clearly be shown in the line diagram.

Tank cleaning details and dates to store the LSFO must be present in onboard records, including Oil Record Book.

The bunker details with LSFO must be recorded in the Oil Record book and signed by both Master and Chief engineer.

All records of any internal transfer, retention, disposal etc related to fuel oil will be cross-checked by the port stat inspector, hence these records need to be properly maintained.

4. Fuel Transfer plan and Piping Diagram

The plan and piping diagrams are important too as the PSC inspector will ask them to study them to understand whether the fuel change-over has been done properly, by cross-referring the data in the BDN, LSFO record book and ORB.

The location of the tank, the number of tanks used, pipelines in play etc. will be studied from the piping diagram. Any modification done for the storage and transfer of LSFO must be indicated and have survey approval from relevant authorities.

Ships visiting Emission Control Areas must have a Fuel oil change over plan to use fuel with 0.1% sulphur content. The plan must be readily available in the engine room and ship staff must know the detailed procedure as PSC inspector may ask them the procedure and local regulations.

If the PSC has doubts about the fuel and the lab results are not available, they will take the sample from service and settling tank for their own oil analysis.

Related Read: Fuel Oil Change Over Procedure for Ship’s Main and Auxiliary Engines

5. IAPP Certificate:

As per the MARPOL Annex VI requirement, all 400GT and above ships are bound to carry a valid International Air Pollution Prevention Certificate and supplement as a confirmation that the ship is fulfilling the requirements of this Annex.

The Supplement of the IAPP certificate provides the details of Sulphur Oxides and Particular Matter and how the control of emissions from the ship is achieved. It also contains the sulphur content limit values for fuel for ships plying within the ECA.

Any additional equipment fitted to reduce the sulphur content within the required limit such as scrubber tower etc. are also specified in the supplement of the certificate. Thus Master must ensure the IAPPC and Supplement are valid and updated to indicate the compliance arrangements on board which will be checked by the PSC.

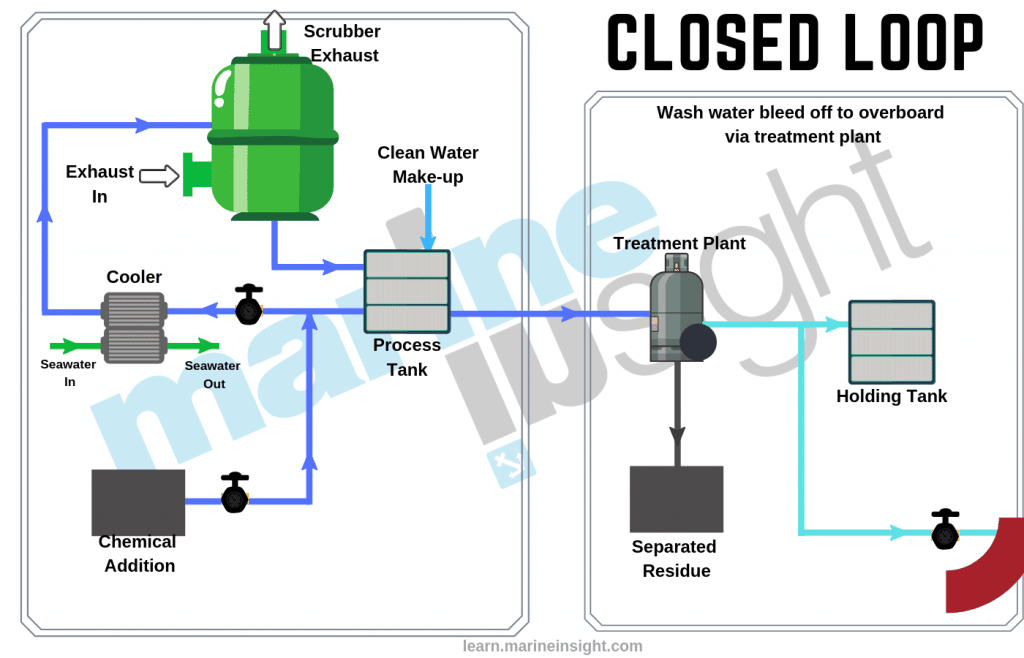

6. Scrubber System:

Most of the ships have adopted exhaust gas scrubber system to comply with the upcoming sulphur emission rule because of the ease of using heavy fuel oil.

The PSC will be having a keen eye for the EGB and following things to be taken care of:

- The Data recorder must be operational and records the time, position, pressure, flowrate etc. of the wash water. The PSC will check all these details to establish the correct operation of the EGB

- The data recording device should be robust, tamper-proof, read-only and able to record at a rate not less than 0.0035 Hz

The data should be retained on board ship for 18 months - The ship officer must take out the recent data in readable format for Port state inspector in case he/she demands it

- PSC inspector may ask and check the approved documentation relating to any installed exhaust gas cleaning systems

- At each renewal survey, nitrate discharge data is to be available in respect of sample overboard discharge is drawn from each EGC system within the previous three months before the survey.

- The nitrate discharge data and analysis certificate is to be retained on board the ship as part of the EGC Record Book and made available for PSC if requested

Different port states have different regulations for the requirement of the open and closed-loop system. The ship officer must know if the port allows open scrubber or closed scrubber system to be operational in its territory and prohibit the discharge of effluent.

Related Read: 14 Technologies to Make the Ultimate Green Ship

The Port state inspector may demand to check the state of the wash water discharge pipe if it contains oil or not.

7. Record of Voyage:

The voyage records must be kept onboard as PSC inspector may demand to see the previous passages of the ship to know the time and coordinates for the entry in the port state or ECAs and if the ship has changed over to the compliant fuel in right time by cross-checking the data with ORB and other record books.

8. Fuel Oil Non-Availability Report:

If a ship is unable to acquire compliant fuel due to non-availability or any other reason, the master has to notify the flag state and other relevant authorities including the nearest or next port state.

This notification is called as FONAR or Fuel Oil Non-Availability Report.

This FONAR application and replies of the flag state respectively should be available for the PSC inspection. FONAR should be used only in case of extreme emergency and when all efforts fail to acquire a compliant fuel.

The PSC inspector will go through the report, correspondence and other details to accept the FONAR. However, a repeated FONAR may lead to negative reviews against the ship and the owner.

Source:

https://www.marineinsight.com/guidelines/how-ships-can-prepare-for-psc-inspection-for-imo-2020/